| 1.) What is SleekOptions.com?Show Answer |

| | This is a software tool to help you identify potentially good option trading setups. Not a typical trading guru service. The software uses proprietary algorithims to identify and alert the setups. Please review the below 'how to guide' and the entire FAQ section on how to best use this tool. How to use sleekoptions.com? |

| 2.) What are option alerts?Show Answer |

| |

These are alerts of option alerts triggered by the system (Algo) based on technical and historical data analysis performed on several data points. Consider this as a scanning tool to quickly identify potentially good setups. These setups are not individualized trading advice and absolutely not a recommendation to buy/sell or hold. The primary goal of this tool is to save you time so that you can short list your ideas/watchlist for further research and analysis. The alerts have performed well historically. However, they should be used for trading only after adequate research along with a good money and position size management system.

The algo is purely based on technical and historical data analysis and does not factor things like earning announcements, news, market conditions, option greeks, and any other catalyst. You must trade with a good money/risk management system. The algo uses predictive model to trigger the alerts. By nature, preditive model is based on what happened in the past and the assumption is the same thing might happen again in the future. But predications are not always correct. Some market events are not in our control. The goal of the model/tool is to identify those setups so that we can take timely calculated risks by applying solid risk and money management rules. We are to gain if the history repeats itself. We will loose if it does not. But as a good option trader, you should ensure that your entire account is not wiped out when the algo fails.

|

| 3.) What are the steps required to use the alerts effectively?Show Answer |

| | |

| 4.) I don't have enough experience trading options. However I am impressed with the peak percentage gains posted by the system. Can I use the setups posted here for trading blindly?Show Answer |

| |

The setups are triggered and posted by the system. Even though, the historical performance is good, because the win/loss is not 100%, you cannot trade them blindly. You need a good risk management system to go along. Use the setups as a tool to save the time required to identify good setups. Review the historical performance of any symbol to view the win/loss ratio of the expired setups for the symbol.

|

| 5.) Are all the setups posted by the system a winner?Show Answer |

| |

Absolutely not. The tool is not 100% accurate. For that matter, we humbly believe that there isn't a tool that can predict with 100% accuracy. That is because, in general tools rely on past history to analyse and predict the future move. The problem is, history doesn't repeat all the time. Any event can trigger a market collapse or spark a market rally.

The win/loss ratio and average gain percentage of the setups posted is a good measure of the quality of the outcome produced by any tool. You can measure the value provided by sleekoptions.com tool by reviewing the win/loss ratio and average gain percentage metrics for a few symbols based on the past performance of the setups posted.

The primary goal of this tool is to help you save the time required to identify a potentially good setup. We believe it is a significant time saver as it is not possible for a human to keep track of all the moves. Our scan engine can process huge volume of data quickly and alert if something has the potential to be profitable based on proprietary algorithm.

Please note that algorithm does not factor events such as earnings, news, financials and other fundamentals of the company. The tool does not look at Option Greeks either.

From a risk management perspective, because the tool is not 100%, you should not be investing a lot of money in a single trade. And when you invest a lot of your capital in a single trade and if that happens to be a losing setup, even though the setup is generated by the tool, that one bad trade can wipe out your entire account balance. Options are very risky and you need a good risk management system to go along with your research. No matter how good a setup is, one bad news or a broad market event or even a choppy market, your position can nose dive and never recover. You also have other risk aspects to consider in option trading such as liquidity, volatility (IV) and time decay.

|

| 6.) Why should I focus only on a few symbols?.Show Answer |

| |

You don't have to. But it is recommended to focus on just a few symbols for several reasons:

1.By focusing on a few symbols you get to know the terrain of the stock better. By terrain, we mean the resistance and support zones, swing points and price action.

2.The difference between focusing on a few symbols and looking at everything is like the difference between driving a familiar route and driving on a route that is totally new. Imagine driving the same route every day, you are almost robotic, mechanical and swift. You don't even realiaze that you have driven and some how magically reached the destination. Such is the power of focusing on a few symbols.

3.Focusing on a few symbols is a tool to be disciplined and control your mind and not get into forced trading or over trading.

4.You are more likely to get whipsawed when you keep jumping symbols resulting in erratic unplanned trading.

5.A lot of times, the oppurtunity looks good only until you are not in and just watching on the sidelines. The moment you get in, the trade goes against you. In the meantime, the trade that you exited to be in this new trade, will begin to run and make big strides without you. And also, statistically, you have a better chance of recovering your loses in the same symbol rather than jumping to a new symbol. All that you have to do is understand the terrain of the symbol and wait patiently for a favourable setup.

|

| 7.) Focusing on just a few symbols is a good idea. But, I don't want to limit myself to just them, I am concerned about missing out on action on symbols that are not my focus symbols. Any alternatives?Show Answer |

| |

You need to have your focus narrowed down to something. Otherwise, you will be jumping all over the place and get whipsawed.

To narrow your focus, you have two options.

Option A: Focus only on a few symbols and ignore everything else.

(OR)

Option B: Focus only on two chart patterns (one for CALLS and the other one for PUTS). Always try to trade only if the charts displays your chosen pattern after the alerts are triggered by the system. Patiently wait until the pattern is formed. You may miss sometimes. But it is okay. No one can catch them all.

|

| 8.) I understand the importance of focusing on a few symbols. But how do I pick my symbols and how many symbols should I focus on?Show Answer |

| |

1. If your balance is lesser than 10k: 3-5 Symbols. If your balance is lesser than 2k, focus on just 1 symbol.

2. The symbols that you want to focus on, depends on your per trade budget. If your max investement per trade is only $300, you cannot pick AMZN or GOOGL. And you cannot pick way out of the money just because the contracts are cheap and fits your budget. They are cheap for a reason and will probably expire worth less.

3. Look at the past performance for a few symbols and see if they fit all your parameters. You may ask which symbols are good? The algo tracks only 300+ symbols and they have been handpicked already. So any symbol that is covered by the algo is good.

4. In options trading, liquidity and spreads are important. Please look at options volume, open interest and the difference between bid and ask in your trading platform for the chosen symbol. And if you think they are good, then the symbol is a good candidate. The difference between bid and ask of the underlying options are important. If the gap is too wide, it is better to skip or just place an order at a price that is acceptable to you and hope that it fills. For example, if the BID is 2.50 and ask is 3.50, it is too wide. Even if you place your order at 3.00 you straight away lose close to 20%. Hope you get the point.

5. Also, Review the historical performance of the setups posted by the system as a consideration for short listing your focus symbols.

|

| 9.) Where do I see the list of symbols covered by sleekoptions.com algo?Show Answer |

| | This monthly performance summary by symbol should give you the list of symbols covered by our algo. Symbols Covered by Algo All the symbols are covered for both Swing and Scalp Algo. |

| 10.) How to Update my focus symbols in the website?Show Answer |

| | |

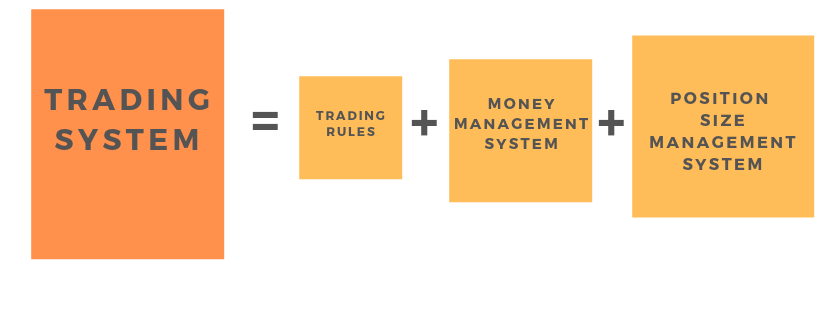

| 11.) What is a Trading System?Show Answer |

| | A 'Trading System' is a name given to a set of rules and processes for your options trading. It is very important to follow a system while trading options to avoid erratic trading and enforce the discipline required to be successful. A 'Trading System' can also be called as 'Risk Management System'. Essentially, a trading system helps you take calculated risks with the primary goal of preserving your capital for as long as possible. Any trading system you create should give utmost importance to capital preservation. A good trading system also factors in for losing trades. If you create a trading system that assumes that all your trades are going to be winners, it won't work well. It is bound to fail at some point in time.  Review Creating your trading system on steps to creating your first trading system. |

| 12.) Can I have multiple trading systems?Show Answer |

| |

It is upto you. For instance, let us say you have 20k account balance. You can dedicate entire 20k for a single trading system or you can divide that balance (logically) into 4 accounts of 5K each and dedicate a trading system for each account. However, if you take the second approach of multiple trading systems, don't mix up the trades. For any trades in a system, follow the rules defined for that trading system. Otherwise, when you measure the performance of your trading system, the results are not accurate.Neverthe less, it is important to create a trading system and follow the system with discipline. A trading system is what will help you take calculated/planned risks. Name each of your trading system, give them an identity. Document your trading system. Review them before every transasction. Measure the performance of the trading system for every 10/15 trades. All this can be done by using a simple excel spread sheet or by using journals in sleekoptions.com. Journals in sleekoptions.com are always free for registered users.

|

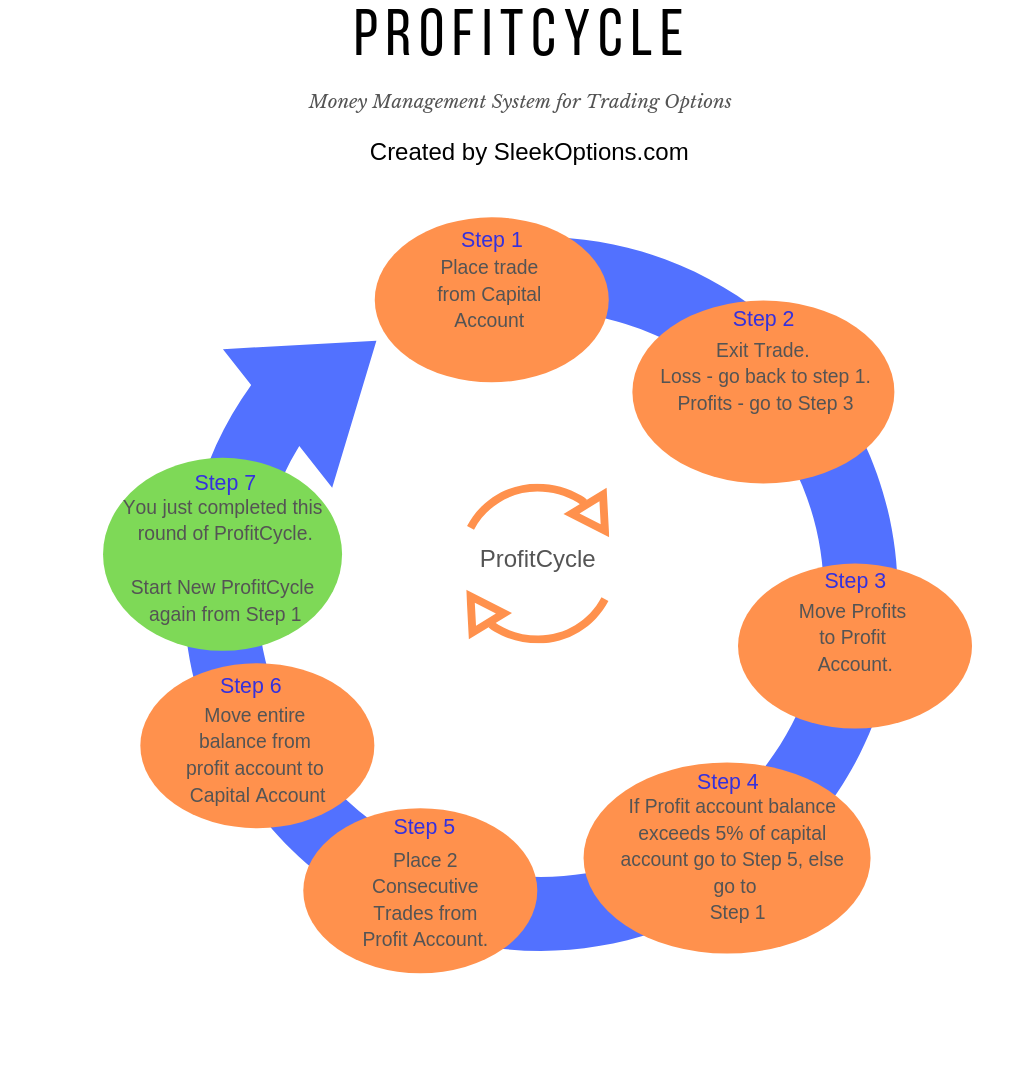

| 13.) What is a Money Management System?Show Answer |

| | Money management is an important aspect of your trading system. It is a set of rules that defines how funds should be managed in your trading account. Sleekoptions.com has created a money management system called 'ProfitCycle' which attempts to find a balance between capital preservation and account growth. Most of the model 'Trading Systems' that is recommened in this website uses the 'ProfitCycle' approach for money management. You can create your own money management system or modify the 'ProfitCycle' money management system to suit your trading style and account size. A trading system witout money management is flawed and not complete in nature. So make sure, your money management is defined and documented as a part of your trading system.  |

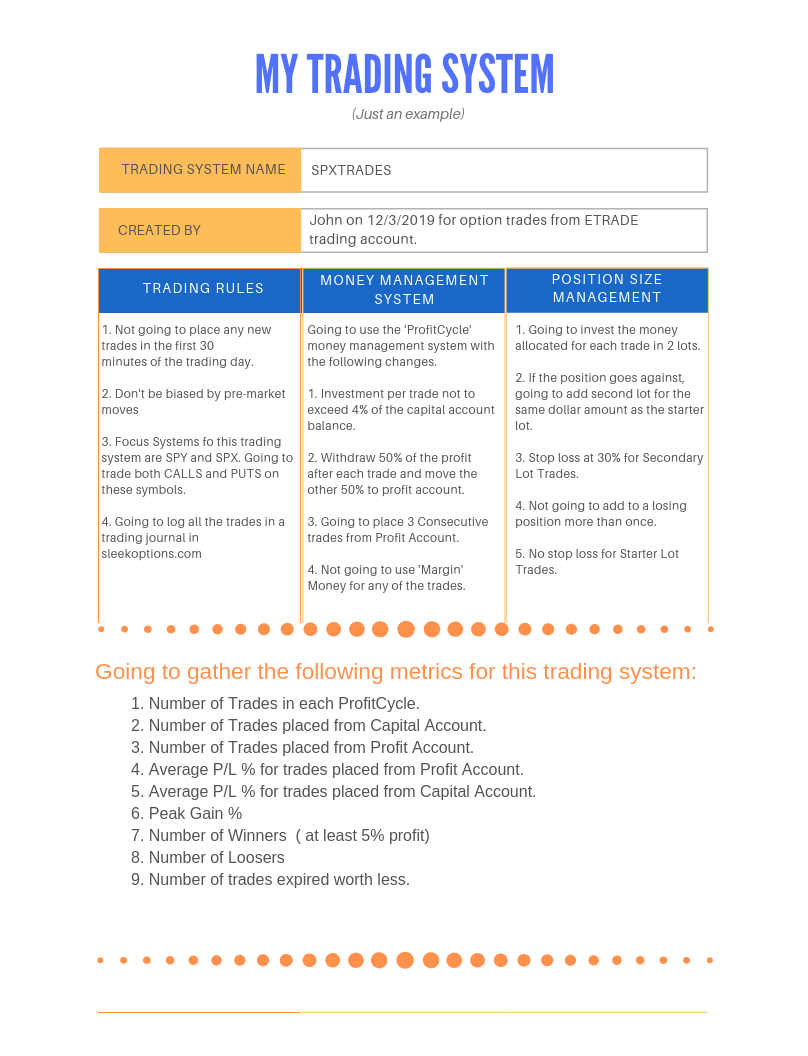

| 14.) What is the difference between Money Management System and Position Size Management?Show Answer |

| | A money management system are rules that dictates how your account balance should be managed. Whereas Position Size Management defines the rules on how each trade should be managed. For example, What do you with the proceeds when you exit a trade with a profit is a rule you define in your money management system. How much you invest in each trade is what you define in your Position Size Management system. There could be some overlaps depending on how you see it. Below is a sample trading system as an example for all three components, Trading Rules, Money Management and Position Sizing.  |

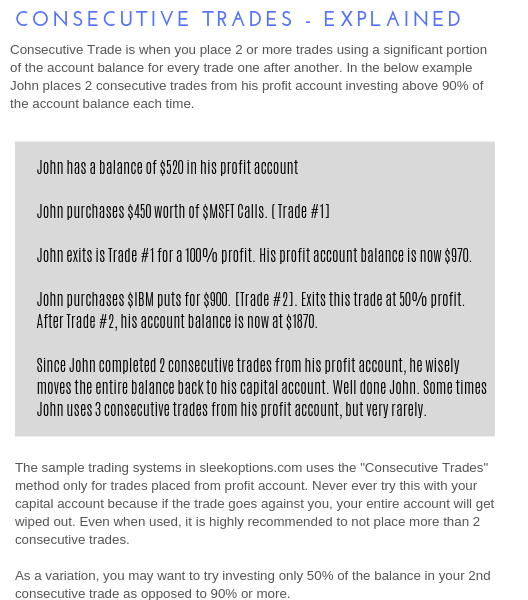

| 15.) I see the term 'Consecutive Trades' used often in the sample trading systems posted in the website. What exactly do you mean by 'Consecutive Trades'?Show Answer |

| | Below picture will clarify this:  |

| 16.) Why do I even need a trading system?Show Answer |

| | It is a must. As a first step, create your trading system even before you place your first trade. A trading system is nothing but a risk management process that you apply on your trading account to preserve capital. You can create your own trading system or take an existing system and modify to suit your account size and trading style. Investing in Options are very risky. In fact, Options are designed so that you can protect your core equity assets. It is like insurance. It is very much possible that you may loose 100% in option trades within a matter of few hours. So, without a proper system to discipline your mind, you will be trading in an erratic and random manner. You may be successful trading that way, but one bad trade can wipe out your entire account if you are not very careful. Essentially, by following a trading system you are switching from random luck driven trading method to a controlled, rules and process driven trading method. Following a system will provide the governance and restraint required to manage your mind. In a controlled system, you will soon discover what works and what doesn't and you have something to measure, tweak and repeat your performance. This leads to an other question. Does following a trading system gaurantee success? Absolutely not. There is no gaurantee in any kind of investment. If you want to put your money to work, it is prudent to invest wisely by taking calculated risks. Trading System helps you to take those calculated risks in a methodical and systematic manner. The algo driven alerts generated by the system should help you save some time which you can spend on research and study. And also following a trading system or for that matter any rule based trading method may help you to trade without any emotions such greed, fear and hope. Controlling these emotions are the driving factor to be successful in options trading and a good trading system provides you the mechanics to control those emotions. |

| 17.) What is the difference between a Primary and Dip Setup?Show Answer |

| |

Primary Setup: A primary setup is triggered by the core sleekoptions.com algo. Generally, you take a starter lot position when the primary setup is triggered. But it also depends on your trading system.

Dip Setups are triggered when a primary setup fails. There are three kinds of Dip setups: Dip-A, Dip-B and Dip-C. These setups are triggered when the primary setup fails to peak at least 35% after they are posted. 'Dip' setups are also called as 'Secondary Lot' setups because they can be used to add to an existing position (2nd lot) in the same direction to bring the average cost down. As a recommendation, don't add to a losing position more than once. And your combined (primary lot + Dip/secondary lot) total investment in a setup should not exceed 3%-5% of your capital account balance.

Dip-A: This setups is triggered when the primary setup failed to peak above 35% and dips around 40% from the posted price.

Dip-B: This setups is triggered when the primary setup failed to peak above 40% and dips around 70% from the posted price.

Dip-C: This setups is triggered when the primary setup failed to peak above 45% and dips around 85% from the posted price.

Please note that, for all the Dip setups, even though the dip% is a major criteria, besides dip%, the system also evaluates additional conditions before triggering the setup. For example, days left to expiry in the primary setup, current stock price and how much they are away from the strike price of the primary setup are some of the additional criteria the system evaluates. And also, only the first dip are captured. If a contract dips 40% peaks and then swings back to gain 110% and again dips at 50%, the second dips are not triggered as we consider this as already a winning setup because it peaked above 35% at some point.

Each of the above setups are further tagged for risk classification as HighRisk, MediumRisk and LowRisk. Please note that LowRisk doesn't mean no risk.

Once again, please remember that setups by themselves will not work in your favour, you may win a few by chance but one bad trade will drag you down. You need a very good position size and money management system to go along with the setups. Please review some of the money management stratagies posted in the website as a sample.

|

| 18.) What is the recommended exit Strategy for Straddles?Show Answer |

| |

Straddle setups are triggered for most of the alerts at the same time the Primary Setups are triggered. Straddles are suitable for traders looking for some protection with limited profits. You don't have to get into straddles if that is not your trading style.

When you buy a straddle, our recommendation is to buy both the legs for the same dollar value and not the same number of contracts. Apply one of the below exit strategies based on the chart.

* Exit one Leg and keep the other leg open for a reversal play.

* Exit both the legs at the same time. with net Profit.

* Exit One leg and use the proceeds to double up on the other side.

* Exit as per your exit trading rules for CALLS and PUTS.

Which ever exit strategy you use, consistently apply the same strategy for all the trades within the batch. Consistency is the key. Maybe you can adopt a different strategy for the next batch. The goal of the straddles is to have some protection and also to exit with a net profit on the overall cost.

|

| 19.) I see a CALL and a PUT triggered the same day. PUT was triggered 30 minutes after the CALL was posted and I am already in a call, now what should I do with the PUT setup?Show Answer |

| |

This happens 10% of the time for any given symbol. A good example is AMD calls and puts were triggered by the system same day on 3/28/2019. ( Please review). This occurs when the price of the underyling stock swings back and forth at a particular zone confusing the algo. Initially, when a CALL is triggered, we were not posting the PUT or vice-versa. Later, we changed the system to post both whenever the system triggers. We decided to post both and let the users take the decision instead of ignoring the setup. Most of our members would apply a Strangle or Straddle strategy when this happens. A Strangle or Straddle is the name of the options trading strategy where you buy both CALLS and PUTS. The trader gets to profit when one of these not only goes up but also covers the losses on the other side. These are your choices when this happens.

Choice 1. Buy starter lots on both, treating them as a fresh trading signal.

Choice 2. If you are already in one direction, ignore the second setup, but follow the process on your 1st trade.

Choice 3. Trade only the 2nd setup because that is the latest trigger.

Choice 4. Ignore both and wait for a fresh setup.

Choice 5. Review some real time examples and formulate your own strategy for this scenario and make that strategy a part of your trading system.

Regardless of your choice, try to make it a part of your process and trading system and see that you consistently apply the rules.

|

| 20.) What should be my stop loss % for option trades? Any suggestions?Show Answer |

| |

It depends on your risk tolerance and your mindset. There are two schools of thought when it comes to using stop loss for options trades.

In the first, traders believe that an option that lost (say 50%) will never recover and they try to exit the position for a loss and deploy the rest of the capital elsewhere.

In the second, traders believe that options have the potential to reverse from a loss and make a big gain.

There is nothing good or bad about both the methods. They are just two different methods, two different ways to deal with a losing position. It all boils down to defining your risks and what suits you as an option trader.

For example, let us say you have planned to invest a max of $500 per trade. And you want to risk only $250, so you will essentially set a stop loss at 50%. By doing this, you are defining your risk, which is a good thing. The traders who believe in not using stop loss could argue that since you are willing to lose $250 (defined risk) why not invest only $250 max per trade instead of $500 and not use stop loss at all. By doing this, if the options do recover you still have a chance to exit the trade for a small loss or break even or make some gains.

So finally, it depends on how you think and your trading rules. One suggestion is, try to consistently apply the same rule and not keep changing. By applying the same set of rules you have less chance of getting whipsawed and higher chance of success.

|

| 21.) How not to lose money trading options?Show Answer |

| |

By following the below basic rules, you can reduce the risks involved in options trading.

1. Focus only on 3-5 Symbols. Only 2 symbols for accounts lesser than 10k. Don't look outside of your focus symbols. If you don't want to limit yourself to just a few symbols, an alternative is to focus only on specific chart patterns. Ideally one or two patterns. Either way, narrowing your focus is a must for trading options.

3. Invest only 3-5% of your account balance in a trade. ( All lots combined)

2. Stagger your trade in at least 2 lots instead of buying all in one go. For example, if you planned to invest $500 in AMZN calls. First buy for $200 and then add later again for another $300. We call them the Primary Lot and Secondary Lot. Secondary Lot are is also called as Adjustment Lot, because its purpose is to adjust a trade that went wrong. We recommend only 2 lots and not accumulate to a losing position more than once. But that is upto you and your trading system and trading rules. And also, your secondary lot need not be in the same strike, expiry or direction of your primary lot. For example if your 1st lot is CALLS, your second LOT can be in PUTS. Formulate your trading rules for secondary lot and apply the same rules for all the trades within the trading system. Your rules should specify when to add in the same direction and when to add the adjustmemt lot in the opposite direction. Basically, the purpose of the secondary lot or adjustment lot is to add to a loosing position and bring the average cost down. No matter how many lots you stagger your trade, ensure that the combined total investement of all the lots combined in that particular trade follows your money management rules. For example, if your trading rule is to not invest more than $500 per trade, ensure that you don't spend more than $500 on that trade all lots combined. Some folks add the adjustment lot only if the primary lot failed.

4. Don't be over exposed to market in any one particular direction. Not more than 6% of account balance in exposure at any given time. One good news or bad news, and if you are on the wrong side, your balance comes down rather drastically.

5. Be open to market conditions. Don't be biased. Don't be fixated to calls or puts. Instead base your decision on price action.

6. Don't buy options that has only 4 or lesser days to expiry. Time Decay will be high on these contracts.

7. Don't engage in revenge trading. There will be some losers along the way. Don't try to recover a small loss by investing big with the hope of recovering a few percentage points. Instead, just stick to your process.

8. Don't think about quick gains. This mindset is the first step to disaster. Instead focus on your process.

9. Accept that there will be some losing trades along the way. Instead focus on metrics such as win/loss ratio and Avg Gain %.

10. Remove any targets from your mind. You will be forcing yourselves to achieve them and as a result make emotional decisions such as over trading, investing a lot in a single trade and etc. Instead focus on your process and be happy with whatever the process yeilds.

11. Journal your trades. Review your journals at least once a week. Further more, journals will help you to measure metrics such as win/loss ratio and avg gain %. You will also discover what worked and what didn't. You can setup multiple journals for free in sleekoptions.com (free for registered users). The advantage of setting up journals in sleekoptions.com is that, they are updated with delayed market data. You don't have to manually update or carry your excel sheets any more. And also, you will be able to automatically calculate the win/loss ratio and avg gain % of your trading system by creating a seperate journal for each trading system. Journals can also be used a way to paper trade your trading system before deploying real money.

12. Keep your entry and exit criteria very simple. And apply the same rules consistently. People tend to change the rules as soon as they see a losing streak. No matter what the system/rules are, there will always be some losing trades.

13. Don't change something that is already working well for you to optimize improve your results further. Sometimes, when you tweak your rules/system to better your results you may completely end up changing what has worked well so far.

14. You can never catch the absolute bottom or the absolute top. You may exit early and miss a huge run. This happens all the time, cost of doing business. So don't repent on what you missed. This feeling can adversely affect your mindset and may lead to changing your trading system. You may end up waiting too long in your very next trade. Instead keep focusing your process. Have trust in your process and keep going.

15. At times, markets movements and news may tempt you. Don't succumb to temptation. Stick to your process. Everything will look like a good oppurtunity, but the moment you get in, they will start moving in opposite direction. And when you exit the trade will start moving again without you. You may end up getting whipsawed. Instead try to focus on your process and keep repeating the same steps laid out in your process. Routinely and Mechanically without any emotions.

16. You don't have to trade for the sake of trading or because you are idle and bored. Trade when all your parameters for trading are met. It is certainly not entertaining to lose hard earned money. Just be patient and trade your plan. A few days should not matter in the bigger scheme of things.

18. To error is human. But don't repeat the same mistake again. Even worst, over and over again.

19. Don't ask people for opinions after you entered a trade. You will get mixed answers. Always. And this also means you did something wrong with your position size. Do your homework before you enter a position, not after. Fix the root cause.

20. Finally...It is all about process. Process. Process. Process. Stick to your trading rules. Stick to your Trading System. Stick to your process. By following a process, even if you loose money, you will learn and discover why you failed and that knowledge can help you to come up with a better trading system next time. It will help you discover your trading edge. Without a process, not only money is lost (more likely) bu you will also not gain anything in terms of knowledge. Process gives a proper framework and structure to your approach. If you are successful by following a process, it means, now you have a method/system to repeat your success. On the other hand, if you are successful without a process, it means you were lucky and you won't be in a position to repeat your success. Your success was just a random luck driven event.

|

| 22.) How do I cancel the recurring subscription?Show Answer |

| |

Login to your paypal account and cancel the recurring payment. You will have to do this before the next billing cycle starts. You may receive an email from paypal confirming the cancellation.

|

| 23.) Can I get SMS / Email / Mobile Notification of alerts?Show Answer |

| | Notifications, Yes. All the setups are posted in Ryer.com chatroom as and when they are triggered. You can download the ryver.com chat App on your mobile device and set up push notifications.  Only active subscribers can access Ryver.com Chat room using this link: https://sleekoptions.ryver.com |

| 24.) I am getting a lot of PUSH notifications from Ryver Mobile APP. How do I get PUSH notifications only for some teams and not all?Show Answer |

| | By default you will get PUSH notifications from all the team rooms in Ryver App. It may be overwhelming. For instance, you may want to focus only CALLs and not PUTS. Or you may want to get notifications only from your 'Focus Symbol' room and not other rooms. In order to receive PUSH notifications only for specific rooms, you first need to turn off global push notifications and then turn on PUSH notifications only for specific rooms. The below video will demonstrate how to do this and this should help. Video - Ryver Push Notification setup on selective teams.In this above example, you will receive push notification only for those messages posted in the room '_calls scalp'. In addition, you will also receive PUSH notifications on messages posted in any other team rooms only when you are mentioned using the @ sign (@username). |

| 25.) How to join sleekoptions chat room (Ryver Chat Room) using the mobile app?Show Answer |

| |

After your subscribe, please logout of the website sleekoptions.com and log back in. This will ensure that you receive an email invite from Ryver.com. Follow the invite to register in Ryver.com

Step 1: Download Ryver.com Chat Mobile App in your iphone/android device.

Step 2: Open the App.

Step 3: When prompted for organization name, enter 'sleekoptions'

Step 4: Enter your Ryver.com userid and password in the next screen.

Step 5: That should take you to the chat room and you will see all the channels. Only paid members have access to the chat room.

|

| 26.) How to join sleekoptions Ryver chat room using the desktop web browser?Show Answer |

| | After your subscribe, please logout of the website sleekoptions.com and log back in. This will ensure that you receive an email invite from Ryver.com. Follow the invite to register in Ryver.com Step 1: Use this link. https://sleekoptions.ryver.com Step 2: Enter your Ryver.com user id and password and click on the 'Login' button Step 3: That should take you to the chat room and you will see all the channels. Only paid members have access to the chat room. |

| 27.) How do I get setup alerts in the ryver.com Chat platform only for selected symbols?Show Answer |

| | If you are an active subscriber, you will see a private channel in the ryver.com chat platform. The name of this private channel is 'focusedSymbols' followed by your profile name. You can enter your focus symbols in the website under My focus symbols Any time a new setup is triggered the setup will be posted in your private channel in ryver.com Chat platform. You can setup push/email notifications in the platform for this channel any time. The notifications can be turned on/off with just a click of a button. Ryver.com Chat is a great platform and very similar to slack and discord. Our recommendation is to focus only on setups posted for 3-5 symbols.  Only active subscribers can access Ryver.com Chat using the same credentials they use for sleekoptions.com https://sleekoptions.ryver.com |

| 28.) What is the win/loss ratio on these setups?Show Answer |

| | |

| 29.) Can I trade on these alerts?Show Answer |

| | Yes you can. But understand that these are not trading alerts and not a recommendation to buy, sell or hold. We are not a trading advisory service. Sleekoptions.com is software tool to assit you to identify good setups which you can use for further analysis before you place the trade. It is impossible for humans to sit and watch all moves, the intent of this tool is to reduce your work involved in identifying potentially profitable setups. A quick glance at the chart and is highly recommended before you place the trade. Options are very risky and options liquidity is very imporatant as well. Consider all this before you place your trade. Ideally you should paper trade for a few weeks to come up with a trading system that works for you. Take a quick look at Performance of alerts that expired last week |

| 30.) Can I trade on these alerts?Show Answer |

| | Yes you can. But understand that these are not trading alerts and not a recommendation to buy, sell or hold. We are not a trading advisory service. Sleekoptions.com is software tool to assit you to identify good setups which you can use for further analysis before you place the trade. It is impossible for humans to sit and watch all moves, the intent of this tool is to reduce your work involved in identifying potentially profitable setups. A quick glance at the chart and is highly recommended before you place the trade. Options are very risky and options liquidity is very imporatant as well. Consider all this before you place your trade. Ideally you should paper trade for a few weeks to come up with a trading system that works for you. Take a quick look at Performance of alerts that expired last week |

| 31.) What time are the alerts generated?Show Answer |

| |

The alerts are generated as and when they are triggered using the delayed information. Generally the first alert is posted in the website for at around 9:50 AM EST. It also takes some time to process and analyze before they could be posted.

On average a new alert is triggered for a symbol every 5 days.

|

| 32.) Why are the exits not posted? How do I know when to exit a trade that I made based on an alert.Show Answer |

| | First of all, you should not be taking a trade purely based on setup alert. The alert is a tool for you to quickly identify a good setup. Therefore, you should have had an exit strategy even before you place the trade. Identifying exit targets automatically is a complicated process. We are still working on it and backtesting them. As soon as they are properly tested, we will enhance the system. Having said that, trading styles vary from person to person. Some of them would like to exit as soon as they hit a certain profit percentage where as others exit based on technical levels. Our assumption is that you know a little bit of technical analysis to identify exit zones yourselves. Use the alerts a tool to help you identify good setups. Once you are in a trade watch for technical levels and exit based on that. Take a quick look at Performance of alerts that expired last weekExits are posted for alerts logged in any of the journals under sFolio. Please review detailed FAQ on sFolio. |

| 33.) What are sFolios?Show Answer |

| |

sFolio are model trading journals where both the entry and exits are posted by the algo. The purpose of sFolio is to demonstrate position size and money management techniques. A sFolio is a trading Journal automatically managed by the algo for a given trading system. All the entry and exits posted for a journal in sFolio are also posted in Ryver chat room. Please note that they are model trading journals and you can use them for further research and learning. The algo posts entries and exits based on the configuration of the chosen trading system. For example, the 'DragonFly' trading system uses $5,000 as starting capital and focuses only on 2 symbols. This is a conservative trading system where exits are triggered when the algo notices weakness/shift in the prevailing trend. There could be some lag in the price posted in journals on both entries and exits. Active sFolio batches are currently available only for paid subscribers. However, anyone can view the trades posted for sFolio batches that are already closed. Only a certain number of followers are allowed for a given batch. Batch is locked as soon as the batch becomes full or when first trade is posted by the algo. Don't trade the entries blindly as the algo does not factor news and other fundamentals. These are model journals to demonstrate and teach how money and risk managemen principles can be applied with discipline and patience.

|

| 34.) Can you give an example on what happens when you don't follow a good money management system?Show Answer |

| |

Sure. Let us see what happens to Mr.X who has the bad trading habbit of investing a significant portion of his account balance in one option trade.

Day 0: Account Balance is $10,000. Freshly funded.

Day 1: Purchases 9 Contracts of $CMG at $10 each. Account Balance is now at $1000.00.

Day 4: Exits 9 contracts at $15 (50% profit). Account balance now at $15,000. He feels good and confident.

Day 5: Purchases 10 Contracts of $AMZN at $14 each.

Day 6: Exits the 10 Contracts of $AMZN at $20 each. He gains confidence. He credits himself for being so good. Account Balance now at $21,000, he is happy. Almost doubled the account in just 3 days. That day, he buys flowers for his wife. Sleeps well and looking forward for the next day. Also, started dreaming about paying off his $50,000 debit in a couple more trades, buy multiplying at the same rate. Numbers running all over his head.

Day 7: Saturday. Holiday. No Trading. But he is anxious and looks for the next setup all day in sleekoptions.com

Day 8: Sunday. Holiday. Even though he did good, he is stressed and anxious about the next trade. He begins to comtemplate if he should invest big one more time or go small. Keeps thinking about his next step all night.

Day 9: He decides to invest big, one last time. So he purchases 10 contracts of GOOGL at $20 each. The setup looked very good. And historical performance of GOOGL in sleekoptions.com looked good as well. He is happy but still anxious.

Day 11: Bad news comes out pre market. GOOGL Shares we trading down 2% pre market. A 2% down in stock may result in 50% loss in options. As soon as the market opens, he panicked and exited GOOGL at $11 per contract. Account balance came down to $11,000.

Day 12: He is worried that he lost a lot of money, but consoles himself saying I am still $1k more than where I started. He does not place any new trade.

Day 13: He says to himself, ok, one last time I will invest big and then I will follow the process. Purchases $AMZN 11 contracts at $10 each. 100% of his account balance invested in just one trade. Fingers Crossed. This is revenge trading. He wants to recover the losses quickly back from the market.

Day 14: Market bad news continues. AMZN stocks went down. Now his options are worth only .25 cents each.

Day 15: Since it is almost worthless he lets the options expire worth less. Account wiped out in exactly 15 days. Job badly done. Now he is pondering where he went wrong.

So the moral of the story is, no matter how good the setup is, it is probability driven. You have the same chances of failure and success. The setups look awesome, everything looks great, but still you can't predict what is going to happen the next hour. The only way to be profitable in options trading is to be wise with your capital and keep taking small calculated risks. Before you place a trade, instead of thinking about how much you can profit, you need to think about how much you are risking.

|

| 35.) The historical performance of alerts are good, what is that based on?Show Answer |

| | It is based on an algorithm (secret sauce) we researched and fine tuned for several years and back testing them over and over again. What we found is that, these setups along with good money management system has the potential to give decent profits if used properly with a lot of discipline. One of our golden rule is to never invest more than 2-5% of the account balance in any trade and not to have more than 6% of your account balance in market exposure at any given point. The percentage returns for the alerts are attractive and sometimes tempting to invest big. But that is a big mistake; you never know when the market will turn against you. And when it does, and if you have a lot of money in active positions, your entire account can get wiped out very quickly. Take a quick look at Performance of alerts that expired last week |

| 36.) How accurate is the data?Show Answer |

| |

The data may not be 100% accurate due to several reason. But mostly good. We depend on several systems for data and processing and there could be some lag some times. The purpose of this tool is to automatically identify a good setup. And our goal is to simplify things for you, so you can spend quality time on researching after the setups are identified. Always check and verify the data in your trading brokerage platform.

|

| 37.) Can you provide some guidance on when to exit?Show Answer |

| |

Sure. We are working on some content to tackle exits. Will keep you updated. Until then, rely on your technical analysis skills.

|

| 38.) How are the 'Max Profit'/'Peak Profit' calculated?Show Answer |

| |

Max/Peak profit is calculated based on the maximum day high of the options price since the time the alerts are posted until the options expire.

|

| 39.) Can you recommend some trading sytems?Show Answer |

| | They are posted in the website. Money Management Strategies. It is very very very important to follow money management system, especially when trading with options. Don't ever think of doubling or tripling your account quickly. Take it slow. Enjoy the process of making money. Think of options trading as any other business and don't invest all your $ in one single trade. |

| 40.) How do i see all the alerts (historical) posted for any particular symbol.?Show Answer |

| | |

| 41.) Why is money management important for options trading?Show Answer |

| |

It is very important. Consider this scenario; let us say you have $5000 in your trading account to begin with. And you invest the entire $5000.00 in one trade because the setup alert was good. Luckily you made 80% on your first trade. Now your account balance is $8000.00. You gain confidence and you repeat and you invest the entire $8000 in one or two trades the next time, and luckily they went up 100% and now your account balance is $16000. You are over excited. Your wisdom said stop it, but your mind wants to try one more time. You promise yourself that this is going to be last big trade and then you are going to be disciplined from then on. You invest the entire $16000 in a single trade. Even though the setup was good, the next day there was a bad news and markets tanked by a marginal 175 points. Even though it is marginal, now your options come crashing down due to time decay and volatility and your account is wiped out. This is what happens when you don't follow a money management system or you have a system but did not have the discipline to follow it. Options are a very good instrument to earn some decent extra money. But once you let your emotions such as greed, fear and hope take over; it is very difficult to recover from losses.

|

| 42.) Can I get twitter notification of the setup alerts?Show Answer |

| |

We are working on this as well. We will keep you posted. Even if we implement this feature, this may be available only for paid subscribers.

|

| 43.) Are you planning on a chat room service?Show Answer |

| | We have a chat room in Ryver.com Chat platform. Even though it is a chat room, we technically use this room to post alerts triggered by the algo and not to discuss trade ideas.  Only active subscribers can access Ryver.com Chat https://sleekoptions.ryver.comWe don't provide individualized trading advice as we are not a trading alert service. The channels in the chat is room is mainly used for the purpose of posting setups so that subscribers can set up push/email notifications on the platform. |

| 44.) Do you trade all the alerts posted here? How do we follow your trades?Show Answer |

| |

We are a software company and not a typical trading alert service. We are not trading gurus. Sleekoptions.com is a software tool that uses proprietary algo to identify good setups. Having said that, even if we want to trade the alerts, we can't trade all of them. Aprox there are 150 alerts generated a day.

|

| 45.) Why are so many alerts generated for the day? How do I know which one is the best pick of all the alerts generated by the system on any given day?Show Answer |

| |

We post alerts on a basket of symbols as and when they are triggered by our system. These are alerts of good setups. Someone out there is watching for alerts on a symbol that you are not watching. As a trader, it is not a good idea to focus on too many symbols. You will succumb to your emotions. You will be constantly 'symbol hoping' and get whipsawed in the process. It is better to focus only on selective symbols (5 to 10) for a period of 6 months and trade only on them. You will be surprised that by just focusing on a few symbols gives better results than focusing on many symbols. Check out our ROI Analysis (beta) page for more details. Now, the second question, how do I know which alerts are good? The answer to this question is, based on historical performance, all the alerts are equally good. However, our success rate is not 100%. It means there are some false positives every now and then. That is where money management and position size management comes into play. If you are expecting all your trades to be a winner, you are unrealstic. It is very difficult to achieve that. One thing you can do is, take a quick look at all the alerts generated for a symbol and see how the returns are and how many days it took to get peak profit on the alerts generated for that symbol. That should give you some idea on how a particular alert performed in the past. Now combine that with your technical analysis before you place your next trade.

|

| 46.) I don't see any alerts at all for some symbols. Why?Show Answer |

| |

We are processing and analysing only 300+ symbols. These symbols are handpicked by us because we think these are good for options trading. If you like a symbol to be included, please let us know. We will take a look. Another reason why we have only 300+ symbols in our system is it adds to the processing time. We want to post alerts as quickly as possible and we feel these 300+ symbols are good enough.

|

| 47.) All the alerts are based on straight calls and puts. Can you include spreads in future? Show Answer |

| |

These alerts are not trade alerts. We understand that by selling options instead of buying them, time decay and voltality plunge are on your side. We understand the importance of spreads based strategy in options trading and will try to implement in future. In the mean time, you can try to formulate your own spreads strategy based on the directional of the alerts triggered by the system. You can use this as a time saver tool to identify your spread set ups.

|

| 48.) Is there a iphone/android App?Show Answer |

| |

No. We don't have an app. However, all the setups are posted in a channel in https://sleekoptions.ryver.com chat platform. This service is available only for subscribers. Subscribers can login to ryver.com mobile app.

|

| 48.) Is there a iphone/android App?Show Answer |

| |

No. We don't have an app. However, all the setups are posted in a channel in https://sleekoptions.ryver.com chat platform. This service is available only for subscribers. Subscribers can login to ryver.com mobile app.

|